We offer specialised asset management services to institutional clients both domestically and internationally. As part of Aktia Group we are one of the leading asset managers in the Finnish market. Our experienced team has a strong track record and can offer unique know-how in our chosen areas of expertise. Outside the Finnish market we offer selected strategies through our partners.

Active

We believe in active asset management, using our insight and expertise to provide real added value for our clients with every investment decision we make. In our book indices are not meant to be followed. They are there to be beat.

Responsible

We are in this for the long haul – have been since 1826, and plan to be for at least another 200 years. We know that responsibility as an investor, as a corporate citizen and as an employer is the only way forward. Think further

is not just our customer promise, it’s company policy.

Ambitious

We like to do things our way, and we like to do them properly. We know we can not be best in everything, so we focus on what we really know we are good at. The rest we are happy to leave to others. This has earned us a lot of awards over the years. But most importantly, it has earned us the continued trust of our clients.

Aktia’s emerging market fund was awarded the best in Europe

Aktia Emerging Market Local Currency Bond+, which invests in local currency bonds in emerging markets, was awarded the best fund in the Bond Emerging Markets Global Local Currency series in Europe during a review period of three and five years.

News

Aktia was awarded the best European fixed income fund house

Aktia was awarded the best European fixed income fund house in the series for small fund houses in the Refinitiv Lipper Fund Awards comparison. In addition, Aktia's funds once again collected first prizes in both the Nordics and Europe.

Aktia Best Fixed Income Fund House in Finland

Aktia was selected the best fixed income fund house in Finland in the Morningstar Awards 2022 comparison. In the same comparison, Aktia’s balanced fund Aktia Wealth Allocation+ Moderate was selected as the best balanced fund in Finland.

Aktia Mastering the Dynamics of EMD Investments

“The diversification benefit is really important, particularly within the local currency market where correlations with traditional asset classes are low, and even more so within frontier local currency markets,” explains Henrik Paldynski, the Head of Emerging Markets Debt at Aktia Asset Management.

Aktia’s SFDR Art 9 UI-Aktia Sustainable Corporate Bond awarded with the FNG label

For the first time, the "Forum for Sustainable Investment" (FNG), a sustainable investment forum with more than 200 members that operates in German-speaking countries, has awarded the prestigious FNG label to Aktia’s SFDR Art 9 UI-Aktia Sustainable Corporate Bond. Read more

Aktia joins the ASCOR project as the only Finnish asset manager

Aktia is the only Finnish asset manager involved in developing a global framework for assessing sovereign debt issuers on climate change. Read more

UI-Aktia Sustainable Corporate Bond Fund obtains its first certification with top ratings from Nummus.Info

UI-Aktia Sustainable Corporate Bond Fund, has received the Nummus Ethics Certification for conforming with the guidelines expressed by the Conferenza Episcopale Italiana (CEI). The certificate ensures that the portfolio adheres to ethical and sustainable values. Read more

Trip Notes

Central Eastern Europe: Hungary, Poland, and Romania 2023

African Development Bank Group Annual Meetings 2023

Southeast Asia: Indonesia, Malaysia, and Thailand 2023

Sub-Saharan Africa: Angola and Zambia 2023

Central America: Costa Rica, El Salvador, Guatemala, and Panama 2023

IMF Annual Meetings Fall 2022

Investor & Policymakers Roundtables in Ghana 2022

Southern Cone: Argentina, Chile, and Uruguay 2022

IMF Annual Meetings Spring 2022

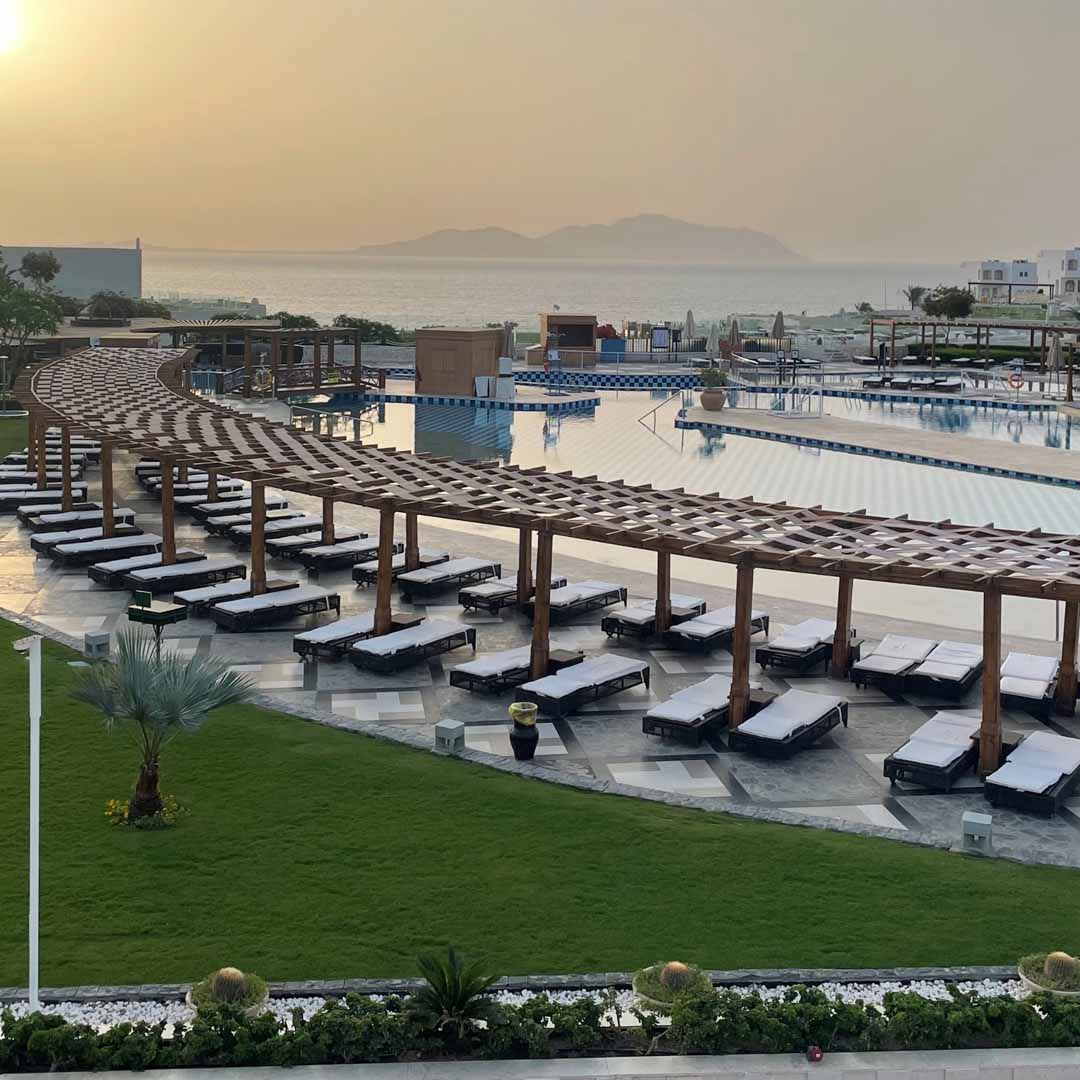

Egypt 2022

.jpg?sfvrsn=521eedc7_3)

.jpg?sfvrsn=64c6b28_3)

Award-winning expertise

The high quality of our asset management services receives regular recognition – when it comes to portfolio management as well as to institutional client satisfaction.

Morningstar Awards

Best Fund House Overall 2021, 2022

Best Fund House Fixed Income 2013, 2014, 2015, 2018, 2019, 2020, 2021, 2022, 2023

Best Equity Fund House 2021

Best Balanced Fund (Aktia Wealth Allocation+ Moderate B) 2023

TOP 3 European equity

funds 2021

TOP 3 Nordic equity funds 2021

TOP 3 Fund House Overall 2019

TOP 3 Fund House Fixed Income 2016, 2017

Best Balanced Fund (Aktia Secura) 2015

TOP 3 Balanced Fund (Aktia Solida/POP Vakaa) 2019

Best Fixed Income

Fund (Aktia Government Bond+) 2019

TOP 3 Fixed Income Fund (Aktia Corporate Bond+) 2015, 2016, 2017, 2018

TOP 3 Fund House, Multi Asset 2013

Lipper Fund Awards

Best fund Mixed Asset EUR Cons Global 5 years: Aktia Wealth Allocation 25 B 2024

Best fund Bond Emerging Markets Global Local Currency 3 and 5 years: Aktia Emerging Market Local Currency Bond+ 2024

Overall Group Award Europe: Small Company Fixed Income 2023

Best fund Europe, Germany, Austria, Nordics Bond Emerging Markets Global Local Currency 3 years: Aktia EM Local Currency Frontier Bond 2023

Best fund Equity Nordic Small and Mid-Cap 3 and 5 years: Aktia Nordic Micro Cap 2023

Best fund Nordics Mixed Asset EUR Balanced-Global 3 years: Aktia Varainhoitosalkku+ Tasapainoinen 2023

Best Fund Over Past 10 years, Bond EUR Corporates: Aktia Corporate Bond+ 2022

Best Fund Over Past 5 years, Equity Nordic: Aktia Nordic 2022

Best Fund Over Past 5 years, Equity Nordic Small and Mid-Cap: Aktia Nordic Micro Cap 2022

Best Fund Over Past 5 years, Bond Global EUR: Aktia Bond Allocation 2022

Best Fund, Bond EUR Global Corporates: Aktia Corporate Bond+ 2020

Overall Group Award: Small Company Fixed Income 2019

Best Fund, Fixed Income: Aktia EM Local Currency Frontier Bond+ 2019

Small Company 2017

Mixed Assets 2008

Nordic Fund Selection Awards

Fund House Fixed Income 2013, 2014, 2015, 2018, 2019

TOP 3 Fund House Fixed Income 2016, 2017

TOP 3 Fund House Overall 2019

Best Balanced Fund (Aktia Secura) 2015

TOP 3 Balanced Fund (Aktia Solida/POP Vakaa) 2019

Best Fixed Income

Fund (Aktia Government Bond+) 2019

TOP 3 Fixed Income Fund (Aktia Corporate Bond+) 2015, 2016, 2017, 2018

TOP 3 Fund House, Multi Asset 2013

Scandinavian Financial Research

Platinum Award 2010, 2012, 2013

Gold Award 2011, 2015, 2016, 2017, 2019

Kantar Sifo Prospera

2013 #4, 2014 #6, 2015 #4, 2016 #5, 2017 #3, 2018 #3, 2019 #6

This is a marketing communication. Historic yield is no guarantee for future development of yield or value. Past performance does not predict future returns. The value of investments may increase or decrease. The investor may lose some or all of the invested capital. The customer should always refer to the PRIIPS KID before making any final investment decisions. The content should not be considered as personal investment advice or investment recommendation. The offering, sale and/or distribution of the products or services described on this website are not intended to any US Persons. Any material on this website or copies of it may not be distributed to the United States or to US Persons as it is against restrictions imposed by laws and regulations by Aktia Bank Plc.

The Refinitiv Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is an objective, quantitative, risk-adjusted performance measure calculated over 36, 60 and 120 months. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see lipperfundawards.com.

Indicators produced by © 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

/aktia-studio_77_1920x1440_v2.jpg?sfvrsn=f0123221_7)